Getting My Dental Debt Collection To Work

Wiki Article

Personal Debt Collection - Questions

Table of ContentsThe 9-Second Trick For International Debt CollectionFascination About International Debt CollectionThe Ultimate Guide To Personal Debt CollectionThe Personal Debt Collection Diaries

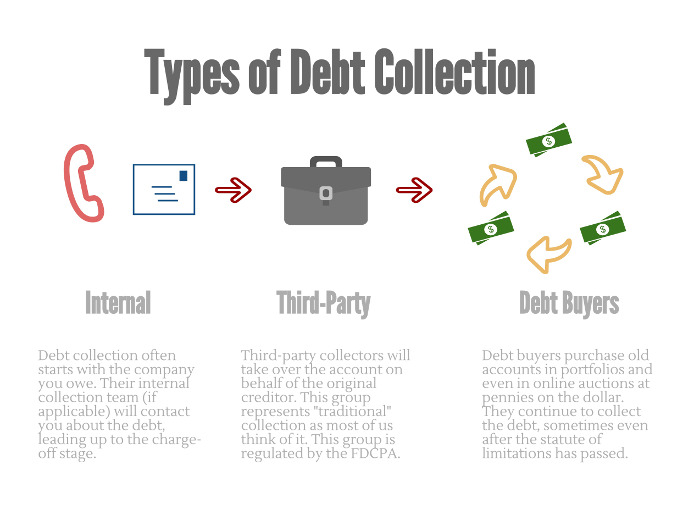

A financial obligation collector is an individual or organization that is in business of recouping money owed on overdue accounts - Dental Debt Collection. Lots of financial obligation collection agencies are hired by firms to which cash is owed by people, running for a flat charge or for a percent of the amount they have the ability to gatherA financial obligation collector tries to recover past-due financial obligations owed to financial institutions. Some debt enthusiasts purchase delinquent debts from financial institutions at a price cut and also then seek to gather on their own.

Financial debt enthusiasts who breach the policies can be taken legal action against. When a consumer defaults on a debt (significance that they have fallen short to make one or even more required settlements), the lending institution or creditor may transform their account over to a debt collector or debt collectors. At that point the financial debt is claimed to have mosted likely to collections.

Some business have their very own debt collection divisions. Many locate it easier to work with a financial debt collection agency to go after unsettled financial debts than to go after the clients themselves.

Personal Debt Collection Things To Know Before You Get This

Financial debt collection agencies might call the individual's individual as well as work phones, and even show up on their front door. They might also call their family, friends, and also next-door neighbors in order to validate the call information that they have on documents for the individual.m. or after 9 p. m. Neither can they falsely declare that a borrower will be detained if they fall short to pay. Additionally, an enthusiast can't physically harm or endanger a debtor as well as isn't enabled to confiscate properties without the authorization of a court. The legislation likewise gives debtors particular legal rights.

Both can continue to be on credit rating records for up to 7 years and have a negative impact on the individual's credit history, a large portion of which is based on their settlement background. No, the Fair Financial Obligation Collection Practices Act applies just to customer financial obligations, such as mortgages, credit scores cards, vehicle loan, pupil lendings, and also clinical expenses.

The Buzz on Dental Debt Collection

Due to the fact that rip-offs are usual, taxpayers must be careful of any person claiming to be functioning on behalf of the Internal revenue service and also examine with the Internal revenue service to make certain. Some states have licensing requirements for financial debt collectors, while others do not.

A financial debt debt collection agency is a business that acts as middlemen, collecting consumers' delinquent debtsdebts that go to least 60 days previous dueand paying them to the original lender. Debt collectors commonly work for debt-collection firms, though some operate separately. Some are additionally attorneys. Discover more concerning exactly how financial debt collection agenies and debt collectors function.

Financial debt collection agencies obtain paid when they recuperate overdue debt. Debt collection firms you can try here will certainly go after any type of overdue debt, from overdue pupil finances to unsettled clinical expenses.

All about Private Schools Debt Collection

As an example, a firm may gather only delinquent financial obligations of at least $200 and also much less than two years of ages. A credible agency will also limit its job to gathering debts within the law of restrictions, which differs by state. Being within the law of restrictions means that the debt is not also old, as well as the creditor can still seek it legitimately.A financial obligation collection agency has to count on the borrower to pay as well as can not take an income or reach right into a savings account, also if the transmitting as well as account numbers are knownunless a judgment is gotten. This implies the court orders a borrower to settle a certain amount to a certain financial institution.

This judgment allows a collector to begin garnishing wages as well as savings account, yet the collection agency should still get in touch with the debtor's company and financial institution to ask for the cash. Financial debt collectors additionally call overdue borrowers who already have judgments against them. Also when a lender wins a judgment, it can be testing to gather the cash.

When the original financial institution figures out that Business Debt Collection it is unlikely to gather, it will reduce its losses by selling that debt to a financial obligation customer. Financial institutions bundle countless accounts along with comparable features as well as offer them en masse. Debt customers can pick from plans that: Are reasonably new, without any other third-party collection task, Older accounts that collection agencies see this page have stopped working to gather on, Accounts that drop somewhere in between Debt customers often buy these plans via a bidding process, paying generally 4 cents for each $1 of financial debt face value.

Report this wiki page